I’m tracking the prices of investments in each of the six asset classes identified as essential to portfolio diversification and risk management. These asset classes are stocks, bonds, commodities, cryptocurrencies, currencies, and alternative investments. Specific investments tracked include the S&P 500 ($SPY), long-term Treasuries ($TLT), Gold (ounce spot price), Bitcoin ($BTC), the U.S. Dollar, and Comic Books. For comic books as an alternative investment, I’ve chosen the famous Bronze Age key, Incredible Hulk #181, which is the first full appearance of Wolverine. A primary reason to consider this key comic is Disney’s recent purchase of the rights to the X-Men franchise.

One obvious reason to track the prices of these investments is to consider relative performance. Are these asset prices correlated or uncorrelated? Are they volatile or stable? Were we to enter recessionary times, how would these assets perform? Information yields understanding and confidence, preparing us for the certainty of uncertain times.

Investment Diversification – Preparing For The Certainty Of Uncertain Times

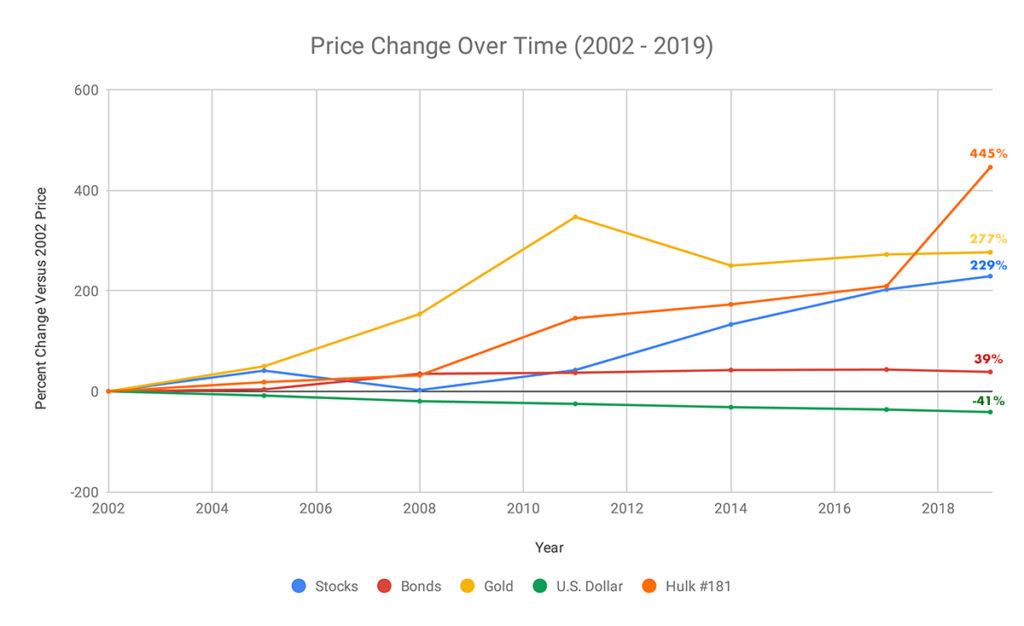

Let’s consider charting price over time of the investments mentioned above. In order to normalize the values of these assets for consideration against the loss of value in the Dollar, I’ve used percent price change over time for the data points. Note that the chart starts at 2002 because that’s when the long-term Treasuries ETF ($TLT) started. Unfortunately, Bitcoin’s history starts after the last big recession, 2008/2009, meaning that we have no understanding of the cryptocurrency’s performance during global bear markets. In fact, Bitcoin has only existed during the greatest stock market bull run of all time. Because of this BTC will be removed from today’s chart. However, price data is still included in the appendix for those interested.

Asset class correlations are visible in the chart above. For example, we see the performance of bonds (long-term Treasuries) and the U.S. Dollar mirroring each other in reverse. This makes sense considering how quantitative easing works. Worth noting that gold has outperformed stocks since 2002. The relationship between stocks and gold is well understood, and we see the expected lack-of correlation during the last recession of 2008/2009 when stocks declined while gold prices increased.

“A Picture Is Worth A Thousand Wordsâ€

For me there are two key points made from this chart. The first is that, not only did inflation reduce the buying power of the USD by 41% since 2002, but stocks increased by 229% over that same period. That means, were an individual to hold Dollars for that period rather than simply holding the S&P 500, he would have actually lost the opportunity for a 270% gain on those Dollars. That’s the opportunity cost of holding a Dollar, showing that Dollars are meant for transactions and not as a store of value.

The second key point made from this chart is that alternative investments = portfolio diversification. As I’ve discussed in the past, key comic books are interesting alternative investments for several reasons, including the 30-year hype cycle, historical and cultural importance, and the recent surge in comic book fandom thanks to Disney’s recreation of the Marvel universe. As one can see, prices of Hulk #181, the first full appearance of Wolverine, have correlated fairly well to gold prices since 2002, including increased auction prices during the last recession. Clearly, key comics can be stores of value, thus proving the point of this article – Don’t Hold Dollars, Hold HULK #181.

Appendix

Here you’ll find more price details on the investments charted.

Asset Class Data Points

I’ve used price points at the end of each year according to the data sources listed below, except in the case of Hulk #181 which doesn’t have daily liquidity.

S&P 500 ETF ($SPY)

- 1993 = $43.59 / share

- 1996 = $73.84

- 1999 = $146.88

- 2002 = $88.23

- 2005 = $124.51

- 2008 = $90.24

- 2011 = Â $125.50

- 2014 = $205.54

- 2017 = $266.86

- 2019 = $290.16 (4/13/2019)

Long-term Treasuries ETF ($TLT)

- 2002 = $88.57 / share

- 2005 = $91.90

- 2008 = $119.35

- 2011 = $121.25

- 2014 = $125.92

- 2017 = $126.86

- 2019 = $122.67 (4/13/2019)

Gold ounce spot price

- 1993 = $391.75 / ounce

- 1996 = $369.00

- 1999 = $290.25

- 2002 = $342.75

- 2005 = $513.00

- 2008 = $869.75

- 2011 = $1,531.00

- 2014 = $1,199.25

- 2017 = $1,275.40

- 2019 = $1,290.50 (4/13/2019)

Bitcoin ($BTC)

- 2011 = $2.00 / bitcoin

- 2014 = $320.19

- 2017 = $14,156.40

- 2019 = $5,088.85 Â (4/13/2019)

U.S. Dollar ($USD)

Measuring inflation – the loss of purchasing value of the US Dollar. If in xxx date I purchased an item for $1.00, then in 2019 that same item would cost: $xxx

- 1993 = $1.00

- 1996 = $1.09

- 1999 = $1.15

- 2002 = $1.24

- 2005 = $1.35

- 2008 = $1.49

- 2010 = $1.51

- 2014 = $1.64

- 2017 = $1.70

- 2019 = $1.76

Alternative Investments

Focusing on Comic Books, specifically Incredible Hulk #181 – first full appearance Wolverine

- 1993 NM 9.0 = $300.00

- 1996 NM 9.0 = $315.00

- 1999 NM 9.0 = $465.00

- 2002 NM 9.0 = $1,100.00

- 2005 NM 9.0 = $1,300.00

- 2008 NM 9.0 = $1,450.00

- 2011 NM 9.0 = $2,700.00

- 2014 NM 9.0 = $3,000.00

- 2017 NM 9.0 = $3,400.00

- 2019 NM 9.0 = $6,000.00

Data Sources

- Hulk #181 prices

- S&P 500 prices

- Gold prices

- Treasuries ETF prices

- Bitcoin prices

- U.S. inflation calculator

Thanks for reading!

- Worried about historically high stock valuations?

- Wondering if precious metals have a place in your portfolio?

- Not sure if cryptocurrencies are a unique asset class?

- Looking for a review of comic book investing?

Proper risk management and portfolio diversification are not difficult to achieve. What is Investment Diversification? introduces the concept of diversification, defines the importance of risk management, identifies investable asset classes, and then digs into each asset class in depth.