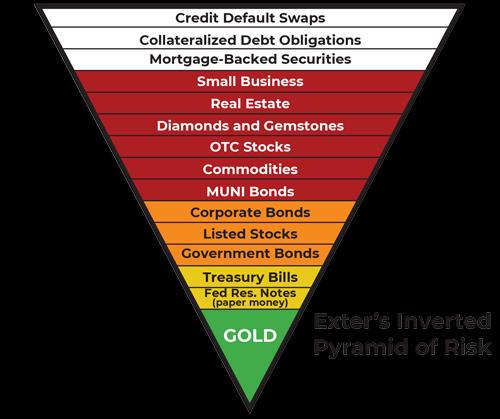

In Exter’s Inverted Pyramid of Risk, gold occupies a unique position at the very foundation—the narrow apex upon which the entire global financial system precariously balances. This placement isn’t arbitrary or based on tradition alone. Rather, it reflects physical gold‘s singular characteristic in the world of assets: it is the only liquid asset devoid of counterparty risk.

What Is Counterparty Risk?

Counterparty risk is the possibility that the other party in a financial transaction will fail to meet their obligations. It’s the risk that someone who owes you something won’t—or can’t—pay. This risk permeates nearly every financial asset in existence, from the dollar bills in your wallet to the most complex derivatives traded on Wall Street. Consider what you actually own with different assets:

A Bank Deposit: You don’t own money—you own the bank’s promise to pay you money. If the bank fails, your deposit is at risk (beyond FDIC insurance limits).

A Bond: You own an IOU, a promise by a government or corporation to pay you back with interest. The bond’s value depends entirely on the issuer’s ability and willingness to pay.

A Stock: You own a claim on a company’s assets and earnings—but only after all senior creditors are paid. The company’s management, market conditions, and countless other factors affect whether this claim has any value.

Paper Currency: Even physical cash represents a claim—in this case, on the government that issued it. As Exter noted, the Federal Reserve can “print all they want at very low cost. Paper money is as abundant as leaves on trees.”

Gold: A Unique Position In Exter’s Inverted Pyramid Of Risk

Physical gold stands alone because it is not someone else’s liability. It doesn’t depend on any government’s solvency, any company’s performance, or any bank’s stability. Gold is not a promise to pay—it is payment itself, with the following critical characteristics:

No counterparty risk: Gold doesn’t depend on anyone’s promise

No credit risk: Gold cannot default or go bankrupt

Cannot go to zero: Unlike stocks, bonds, or currencies, gold has never become worthless

Universally liquid: Gold is recognized and valued worldwide

Immutable: Gold cannot be printed, digitally created, or devalued by decree

This is why Exter, despite spending his career in central banking and understanding the monetary system intimately, chose gold as the foundation of his pyramid. As he put it, gold is “the best store of value money man has ever found over thousands of years.”

See below a modern version of Exter’s Inverted Pyramid of Risk.

The Pyramid’s Critical Insight: The Flight To Quality Is Through A Narrow Door

The inverted pyramid shape reveals a disturbing reality – that a tiny amount of real, counterparty-free assets supports an enormous superstructure of promises and paper claims. This means the vast majority of perceived “wealth” exists only as promises, dependent on chains of counterparties all fulfilling their obligations. During normal times, this system functions smoothly. But during crises, as Exter warned, everyone suddenly realizes they own promises, not assets.

During financial panics, Exter’s pyramid demonstrates how capital flows from high-counterparty-risk assets toward those with less or no counterparty risk. This “flight to quality” follows a predictable pattern:

First Stage: Investors sell the riskiest assets (derivatives, junk bonds, questionable stocks)

Second Stage: They move into “safer” assets like blue-chip stocks and investment-grade bonds

Third Stage: Fear drives them to government bonds and bank deposits

Fourth Stage: Even banks become suspect, leading to physical cash hoarding

Final Stage: The ultimate recognition that even government currency can fail drives the move to gold

Exter documented this progression in 1990-1991 when currency in circulation surged by unprecedented amounts. People were literally pulling cash from banks to store at home—moving down the pyramid away from bank counterparty risk even if they didn’t understand the theoretical framework.

Final Thoughts

Every financial asset above gold’s foundation ultimately depends on someone else’s promise, performance, or solvency.

As we navigate an era of unprecedented monetary experiments, record debt levels, and interconnected financial risks, Exter’s pyramid becomes more relevant, not less. The question isn’t whether counterparty risks will manifest—history shows they always do eventually. The question is whether investors will recognize these risks in time to position themselves at the pyramid’s solid base rather than its precarious top.

When confidence fails and promises break, only physical assets without counterparty risk remain. That’s why physical gold sits at the base of Exter’s pyramid—not as a relic of the past, but as the foundation that remains when everything else built on promises collapses.

“We have now entered a merciless contraction from which gold is by far the best escape.” – Exter

Thanks for reading!