Throughout this series I have focused on a core group of nine Crypto Exchanges that also have their own token. To review, those exchanges include:

Issues in this series include:

- Part 1 (Exchange Basics)

- Part 2 (Token Utility)

- Part 3 (Valuation & Tokenomics)

- Part 4 (The Exchange Matrix)

- Part 5 (Fee-Sharing Exchange Tokens)

Fee-Sharing Exchange Tokens

As I’ve stated previously, my primary objective in cryptocurrency investing is in creating a diversified income stream that also offers the opportunity for capital growth. In traditional investing (equities, debt, commodities) this type of investing is referred to as “income investing.” When focusing on income produced from equities, this is called “equity income investing” or “dividend investing.”

Cryptocurrencies are not securities, so the term “dividend” isn’t technically applicable. We can instead say that some cryptocurrencies “allow investors to earn a share of fees collected by the project.” The effect on our wallets is the same, so this is simply semantics.

Of the nine exchanges above and based on my investment objectives, I find that “fee-sharing” tokens are worth some additional research. These are Aurora Dao, Bibox, COSS, and Kucoin.

Of these, Aurora Dao is my “gem pick.” My reasoning, beyond TVEV, roadmap, and team, includes the fact that fee-sharing income from holding the AURA token is produced by decentralizing the network: Rather than a “dividend”, Aurora Dao is compensating for work done. There’s utility being created through the new Aurora Dao tiered staking system, allowing investors to determine their own level of commitment to the project.

Aurora Dao ($AURA):

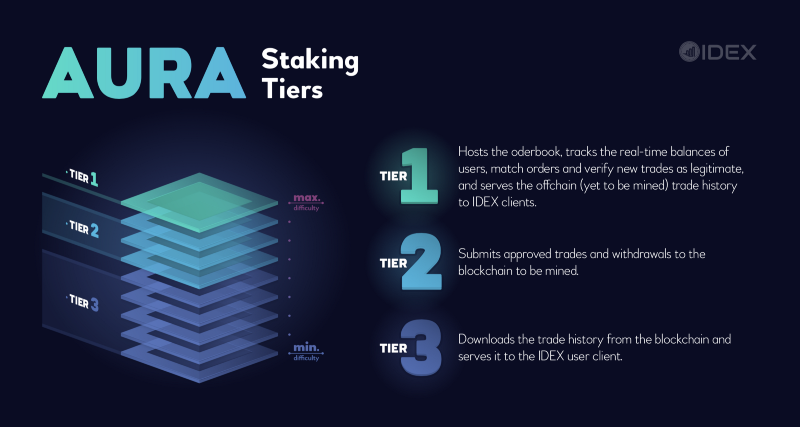

Unlike the other fee-sharing exchange tokens highlighted in this series, IDEX exchange fee sharing requires more than simply holding tokens in a wallet. With the AURA token, fees are collected in return for the computational work, the decentralization, a staker adds to the system for running various unique nodes. Investors are incentivized for the following actions:

- Increasing resistance to DDOS attack and hacks by replacing a central server with a network of node operators

- Improving transparency by providing an open source client that allows anyone to verify the fairness of its trading operations

- Incorporating the community (traders, market makers, investors) into the operations of IDEX, harnessing the network effect made possible through economic incentives. This process will be as inclusive as possible, allowing those with both a small and large stake to participate

- Maintaining the real-time trading experience that has been so instrumental in our current success

Three distinct tiers will be developed:

Tier 3 will have a staking minimum of 10,000 AURA and be the “easiest” tier, in terms of collateral and computational power requirements, while Tier 1 will be the most “difficult.”

“We envision the allocation of fees to be roughly 25% (Tier 3), 33% (Tier 2), and 42% (Tier 1) once the Aurora staking network is fully developed. Please note that originally we anticipated an initial 50% distribution of IDEX fees based on the assumption that all AURA staking would go live simultaneously in Q3. However, given the new strategic rollout plan and our ultimate goal of giving 100% of Aurora of fees back to node operators, we have adjusted the estimated allocations accordingly.”

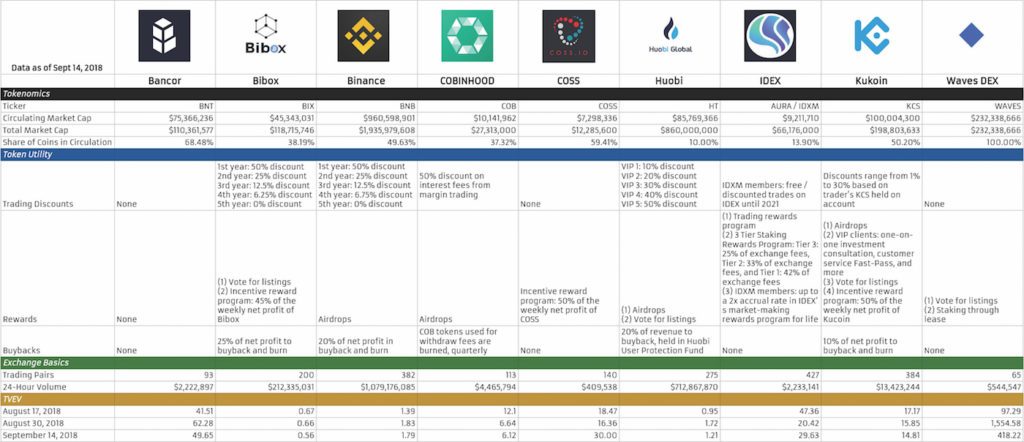

Tokenomics By Exchange:

There were some significant shifts in TVEV ratios for Exchange Tokens over the last couple weeks (8/31 to 9/14). In aggregate, the name of the game for exchange tokens was decreased token price and decreased exchange volume.

Bibox and Huobi bucked the trend with decreased token price and INCREASED exchange volume.

1. Bancor (BNT Token)

Inflation didn’t hurt Bancor too badly over the last couple weeks, and value increased based on falling token value and stable exchange volume. Clearly from the August 30th TVEV is that BNT is overvalued in the 60’s against current market conditions.

- Price: $1.41

- Circulating Tokens: 53,601,424 BNT

- Total Supply: 78,270,622 BNT

- % Tokens in Circulation: 68.48%

- Circulating Market Cap: $75,366,236

- Total Market Cap: $110,361,577

- 24-Hour Volume: $2,222,897

- TVEV:

- August 17th: 41.51

- August 30th: 62.28

- September 14th: 49.65

2. Bibox (BIX Token)

Falling price and increased exchange volume are the trend for BIX, leading to improved value week-over-week. Or … is the falling TVEV value instead an indicator that investors and traders have moved to other exchanges, finding better utility in other exchange tokens?

- Price: $0.443066

- Circulating Tokens: 102,339,166 BIX

- Total Supply: 267,941,449 BIX

- % Tokens in Circulation: 38.19%

- Circulating Market Cap: $45,343,031

- Total Market Cap: $118,715,746

- 24-Hour Volume: $212,335,031

- TVEV:

- August 17th: 0.67

- August 30th: 0.66

- September 14th: 0.56

3. Binance (BNB Token)

Falling token price is the primary reason for the decline seen in the TVEV value for BNB. Based on the spread seen from August 17th to August 30th, the September 14th TVEV value seems a high-middle value.

Let’s watch this over the couple months … BNB fairly valued at TVEV of 1.50 to 1.75?

- Price: $10.06

- Circulating Tokens: 95,512,523 BNB

- Total Supply: 192,443,301 BNB

- % Tokens in Circulation: 49.63%

- Circulating Market Cap: $960,598,901

- Total Market Cap: $1,935,979,608

- 24-Hour Volume: $1,079,176,085

- TVEV:

- August 17th: 1.39

- August 30th: 1.83

- September 14th: 1.79

4. COBINHOOD (COB Token)

COBINHOOD has followed the trend in exchange tokens over the last couple weeks, with both falling token value and falling exchange volume. TVEV for COB has fallen, but this seems more due to a lack of interest in holding than the adoption of exchange utility.

- Price: $0.027313

- Circulating Tokens: 371,323,555 COB

- Total Supply: 1,000,000,000 COB

- % Tokens in Circulation: 37.32%

- Circulating Market Cap: $10,141,962

- Total Market Cap: $27,313,000

- 24-Hour Volume: $4,465,794

- TVEV:

- August 17th: 12.10

- August 30th: 6.64

- September 14th: 6.12

5. COSS.io (COSS Token)

COSS bucks the trend over the last couple weeks with gains for COSS token leading to increased market cap. However, COSS exchange couldn’t defeat the trading bears, and exchange trading volume fell considerably over the same period.

What do we see from increased token price and decreased exchange volume? That’s right –> a pumped up TVEV value, at nearly double the last couple ratings. Tread carefully here!

- Price: $0.061428

- Circulating Tokens: 118,810,622 COSS

- Total Supply: 200,000,000 COSS

- % Tokens in Circulation: 59.41%

- Circulating Market Cap: $7,298,336

- Total Market Cap: $12,285,600

- 24-Hour Volume: $409,538

- TVEV:

- August 17th: 18.47

- August 30th: 16.36

- September 14th: 30.00

6. Huobi (HT Token)

The last couple weeks for Huobi show falling token price combined with increased exchange volume. Expecting to see that the value of HT token would be improved by these conditions, it is no surprise that Huobi’s TVEV value fell.

As with BNB token, I’m wondering if today’s TVEV value reflects “fair-value”?

- Price: $1.72

- Circulating Tokens: 50,000,200 HT

- Total Supply: 500,000,000 HT

- % Tokens in Circulation: 10%

- Circulating Market Cap: $85,769,366

- Total Market Cap: $860,000,000

- 24-Hour Volume: $712,867,870

- TVEV:

- August 17th: 0.95

- August 30th: 1.72

- September 14th: 1.21

7. IDEX (AURA Token, IDXM)

IDEX shows somewhat decreased exchange volume, while AURA token shows a decent increase in price over the same period. This has lead to an increase in TVEV value, but with room for growth as the current TVEV is no where close to the value on August 17th.

- Price: $0.066176

- Circulating Tokens: 139,200,214 AURA

- Total Supply: 1,000,000,000 AURA

- % Tokens in Circulation: 13.9%

- Circulating Market Cap: $9,211,710

- Total Market Cap: $66,176,000

- 24-Hour Volume: $2,233,141

- TVEV:

- August 17th: 47.36

- August 30th: 20.42

- September 14th: 29.63

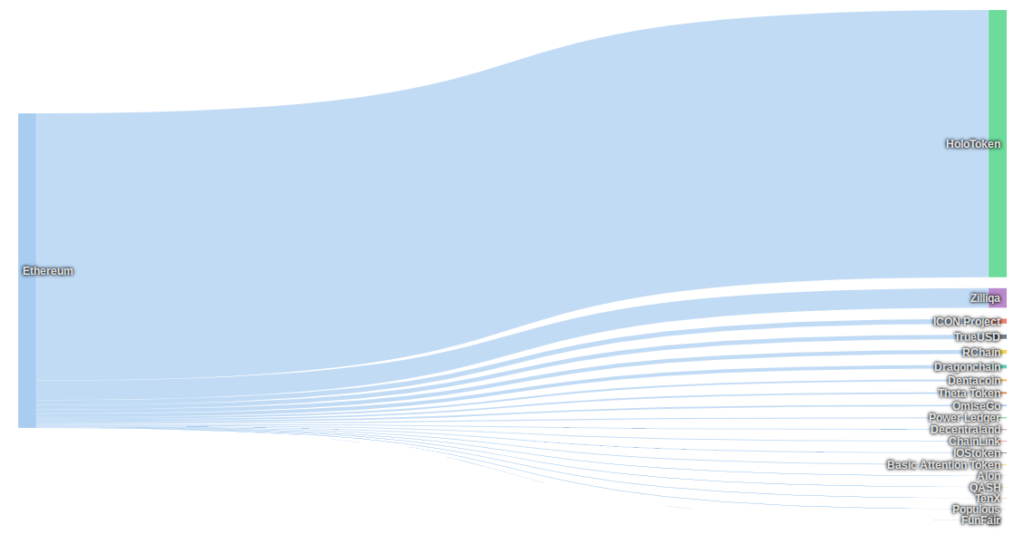

IDEX’s Money Flow in the last 24 hours:

8. Kucoin (KCS Token)

Kucoin’s woes continue as both token price and exchange volume continue to decline, along with the TVEV. Kucoin appears have been over-valued, is approaching over-sold, or both.

It’s still unclear from my limited tracking what is a reasonable value for KCS token. I love the customer service from this exchange, and adds huge value IMHO, but this is another investment I label as “tread carefully.”

- Price: $1.10

- Circulating Tokens: 90,730,576 KCS

- Total Supply: 180,730,576 KCS

- % Tokens in Circulation: 50.20%

- Circulating Market Cap: $100,004,300

- Total Market Cap: $198,803,633

- 24-Hour Volume: $13,423,244

- TVEV:

- August 17th: 17.17

- August 30th: 15.85

- September 14th: 14.81

9. Waves DEX (WAVES Token)

The TVEV values for WAVES are wacky … no other way to put it. Both price and exchange volume are extremely volatile, causing huge swings in the ratio. In any event, the last couple weeks have been good for WAVES, with both increased token value and increased exchange volume.

- Price: $2.32

- Circulating Tokens: 100,000,000 WAVES

- Total Supply: 100,000,000 WAVES

- % Tokens in Circulation: 100%

- Circulating Market Cap: $232,338,666

- Total Market Cap: $232,338,666

- 24-Hour Volume: $544,547

- TVEV:

- August 17th: 97.29

- August 30th: 1,654.58

- September 14th: 418.22

Thanks for reading!