Cryptocurrency exchanges are developing some of the most exciting advancements in the crypto space. Exchange tokens not only facilitate these advancements, but also capture the value of an exchange’s level of adoption (trade volume).

Exchange tokens literally give holders the opportunity to share in the growth of crypto infrastructure. The industry is young, and the opportunities are huge.

Enjoy part 2 of this series! It’s a brief look at cryptocurrency exchange token utility, and a crypto exchange matrix of aggregated data will be produced throughout this series. Don’t forget to check out the other parts of this series as well:

- Part 1 (Exchange Basics)

- Part 2 (Token Utility)

- Part 3 (Valuation & Tokenomics)

- Part 4 (The Exchange Matrix)

- Part 5 (Fee-Sharing Exchange Tokens)

I’m focused on a core group of nine exchanges that not only have a token, but that also have a decent level of transaction volume. Exchanges need volume to survive, and these nine are gaining traction: (listed in alphabetical order)

What are the benefits of Crypto Exchange Tokens?

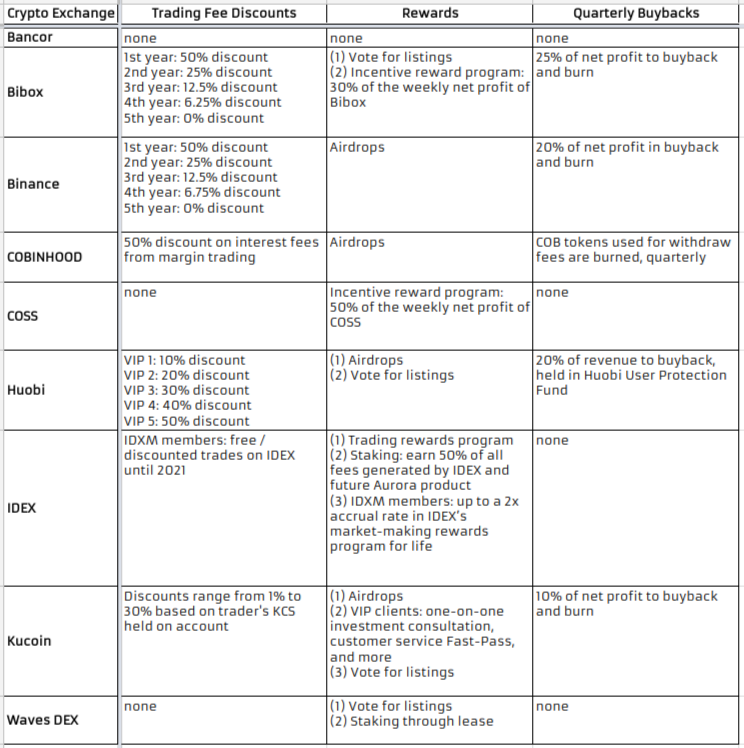

It’s pretty simple, really: for the most part, exchange revenue comes from trading fees. The bigger the volume traded, the more fees generated, the bigger the profit. These profits are shared with token holders in a variety of ways, including but not limited to:

- Trading Fee Discounts

- Rewards

- Quarterly Buybacks

1. Bancor (BNT Token)

BNT is the symbol for the Bancor Network Token, the world’s first Smart Token. BNT is the hub token that connects all tokens in the Bancor Network, allowing them to be easily convertible to each other. While the BNT token does offer an interesting utility in its bridge ability, there are no incentives for long-term holders of BNT token beyond capital appreciation, as seen below.

- Trading Fee Discounts: none

- Rewards: none

- Quarterly Buybacks: none

Resources:

2. Bibox (BIX Token)

Bibox recently made changes to both its fee structure and buyback program, linked below. For example, Bibox increased the rewards of its incentive program and is actively targeting both traders and holders, with qualification for rewards requiring that users trade at least once per week, and the distribution rate of rewards corresponding to how much BIX that user holds on account.

- Trading Fee Discounts:

- 1st year: 50% discount

- 2nd year: 25% discount

- 3rd year: 12.5% discount

- 4th year: 6.25% discount

- 5th year: 0% discount

- Rewards:

- Vote for listings

- The BIX incentive reward program:

- Typically pays out 30% of the weekly net profit of Bibox

- From June 15th to August 3rd, the reward is increased to 45% of trading fees shared with BIX holders

- Quarterly Buybacks:

- Bibox attributes 25% of net profit to buyback and burn

- Most recently, the Bibox team bought back and burned 2,003,300 BIX tokens basing to the profitability of Q2 2018

Resources:

- Fee Structure on Bibox

- New Fee Structure on Bibox

- Bibox Will Update The BIX Incentive Reward Program on 2018.6.15

- Announcement on Second Quarter Buying-Back and Burning BIX Token

3. Binance (BNB Token)

BNB is the ERC20 token native to the Binance exchange and has a fixed supply of 200 million. From this pool, 100 million BNB tokens were distributed during the Binance ICO. BNB can be used to pay any fee on the platform including, but not limited to, exchange fees, withdrawal fees, and listing fees.

- Trading Fee Discounts:

- 1st year: 50% discount

- 2nd year: 25% discount

- 3rd year: 12.5% discount

- 4th year: 6.75% discount

- 5th year: 0% discount

- Rewards:

- Airdrops of newly listed tokens on occasion (Examples include BCPT and ENJ)

- Quarterly Buybacks:

- 20% of net profit in buyback, with 100% burned

- Continues until 100mm BNB are burned (50% of total supply)

Resources:

4. COBINHOOD (COB Token)

With a large portion of COBINHOOD’s income coming from ICO deals, and that market largely drying up in the last three months, will COBINHOOD’s zero-fee incentive structure continue to be profitable? Not only that, but the primary bonus to COB token holders was the opportunity to acquire ICO tokens at discounted rates. With that decline of ICOs, is this still a great advantage for COB holders?

- Trading Fee Discounts:

- 50% discount on interest fees from margin trading

- Rewards:

- Airdrops!

- For example: “If Moxyone reaches 100% of their hardcap, 50% of what #Cobinhood earns will be allocated to #COB #Token #holders”

- Quarterly Buybacks:

- COB tokens that COBINHOOD receives from users withdraw transactions will not be returned to the circulating supply

- Instead, these COB tokens used for withdraw fees will be burned, quarterly

Resources:

- COB Token Upgrade: New benefits for you!

- What is Cobinhood Coin (COB)? A Beginners Guide

- Airdrop Center

5. COSS.io (COSS Token)

With exchange tokens, value is ultimately determined by adoption. In the case of ERC20 token COSS, specifically, investors worry about low trade volume and have taken to Reddit to suggest changes for increasing both listings and trading.

Lacking trading fee discounts and quarterly buybacks, COSS token seems more a dividend stock than crypto infrastructure.

- Trading Fee Discounts: none

- Rewards:

- COSS holders are paid 50% of the exchange trading fee on a weekly basis

- One can hold COSS tokens on the exchange itself or in an ERC20 wallet like MyEtherWallet to receive the rewards

- With Coss, you actually need to buy back your bonus

- This gets around trade laws, which may otherwise may classify the dividend as illegal

- Quarterly Buybacks: none

Resources:

- KuCoin vs Coss: Which Is a Better Investment?

- Suggestions to increase the token usage/purpose/liquidity for COSS tokens in the future

6.Huobi (HT Token)

Huobi Tokens (HT) are the tokens powering Huobi’s blockchain, backed by a loyalty point system. These tokens did not derive from an initial coin offering (ICO). Rather, users acquire HT by purchasing Point Cards on Huobi Pro. A Point Card is Huobi’s pre-paid card used to pay for basic service trading fees, with 1 point = 1 USDT.

- Trading Fee Discounts:

- VIP 1: 10% discount

- VIP 2: 20% discount

- VIP 3: 30% discount

- VIP 4: 40% discount

- VIP 5: 50% discount

- Rewards:

- Airdrops of some newly listed tokens (Example includes Portal)

- Vote for listings:

- 100% refunded

- Airdrops for winning votes

- Quarterly Buybacks:

- Each quarter, Huobi Pro buys back 20% of its revenue on the open market

- 100% of repurchased HTs are held in the Huobi User Protection Fund, to protect users’ interest and compensate for their losses in cases of emergency

Resources:

7. IDEX (AURA Token)

Interestingly, there are actually two tokens related to IDEX and exchange’s parent, Aurora Labs. They are the IDEX Membership token (IDXM) and the Aurora token (AURA).

- Trading Fee Discounts:

- IDXM members are entitled to free or discounted trades on IDEX until the year 2021

- Rewards:

- IDEX has a built-in trading rewards program that grants AURA to traders based on their monthly trading volume

- The AURA token will be used to secure IDEX’s upcoming, fully-decentralized architecture, and AURA stakers will earn 50% of all fees generated by IDEX and future Aurora products in return for their role in securing this network (similar to how Ethereum miners are rewarded in gas fees)

- In the case of IDXM token, members are provided with up to a 2x accrual rate in IDEX’s market-making rewards program for life

- Quarterly Buybacks: none

Resources:

8. KuCoin (KCS Token)

KCS, an ERC20 token, is the native token of the well-known KuCoin exchange. 100 million KCS tokens were distributed in KuCoin’s ICO. Investors holding KCS enjoy not only quarterly buybacks, but also passive income from distributed trading fees.

- Trading Fee Discounts:

- Kucoin’s accounting system decides the discount rate of each user every day depending on the amount of KCS on account

- Discounts range from 1% to a maximum of 30%

- Rewards:

- Airdrops: Kucoin distributes 50% of daily trading fees to KCS holders, with bonuses awarded to users depending on the amount of KCS on account

- It came out that KuCoin does not guarantee they’ll share 50% of their profits

- They actually plan to lower it to 15% as profits increase

- Each day, the bonus is automatically added to your wallet

- When KCS holdings reach a certain level, users enjoy special services such as one-on-one investment consultation, customer service Fast-Pass, and more

- Vote for listings

- Airdrops: Kucoin distributes 50% of daily trading fees to KCS holders, with bonuses awarded to users depending on the amount of KCS on account

- Quarterly Buybacks:

- KuCoin uses 10% of profits to buy back KCS, with 100% burned

- Continued until 100mm KCS are burned (50% of total supply)

Resources:

9. Waves DEX (WAVES Token)

The WAVES token represents innovation, as the Waves platform allowed users to create their own token to fulfill specific needs such as internal currency, decentralized voting, rating systems, loyalty programs, crowdfunding, or even funding startups. Basically, any coins built on the Waves platform are supported.

That said, the WAVES token offers investors neither trading fee discounts nor entitles them to the benefits of quarterly buybacks, as seen below.

- Trading Fee Discounts: none

- Rewards

- Vote for listings

- Staking through lease

- Quarterly Buybacks: none

Resources:

Coming up next:

Stay tuned for Part 3 of this series, which will dig into the valuation of Crypto Exchange Tokens. I will be reviewing such elements as market cap, circulating tokens and the TVEV ratio in order to create a baseline for valuing exchange tokens as under-, over-, or fairly-valued against one another.

Thanks for reading!