How does one value Crypto Exchange Tokens? That’s the million-dollar question to which there are a million answers. Why such difficulty, though? Cryptocurrencies are difficult to value because the industry is relatively new, and use-cases are still emerging. Exchange tokens, specifically, are challenging to appraise because of the difficulty in placing value on the various utility functions served by the token. Further, one can’t help but ask: “Is it really effective to attempt to value emerging technologies experiencing the ‘network effect?'”

Without any doubt, valuing cryptocurrencies requires both subjective and objective measurements. Does one rely on a fundamental or technical analysis? Is price the only relevant metric for success? Does price ultimately reflect user experience? Is there a correlation between sentiment for exchange token capital growth opportunity and exchange trading volume?

The data in this blog post should be considered as a baseline for your research into Crypto Exchange Tokens, rather than law written in stone. I’ll be focusing on one valuation metric today, the TVEV, in an effort to stay focused on small steps of great research that lead, through process of elimination, to undervalued investment opportunities.

Please enjoy part 3 and don’t forget to check out the other parts of this series:

- Part 1 (Exchange Basics)

- Part 2 (Token Utility)

- Part 3 (Valuation & Tokenomics)

- Part 4 (The Exchange Matrix)

- Part 5 (Fee-Sharing Exchange Tokens)

For this series, I’m focused on a core group of nine exchanges that not only have a token, but that also have a decent level of transaction volume. Exchanges need volume to survive, and these nine are gaining traction: (listed in alphabetical order)

What is the TVEV ratio and why does it matter?

T.L.D.R.: The TVEV ratio helps one to better understand how the market prices different token utility models.

Let’s look at a variant of the Bitcoin NVT (Network-Value-To-Transactions) ratio, called the TVEV (Token-Value-To-Exchange-Volume) Ratio, in order to compare Crypto Exchange Tokens values:

Bitcoin’s NVT Ratio is similar to the PE Ratio used in equity markets, and is calculated by dividing the Network Value (market cap) by the the daily USD volume transmitted through the blockchain. When the Bitcoin network is experiencing growth and investors are bullish, or, alternatively, when Bitcoin’s price is in bubble-trouble, Bitcoin will have a high relative NVT. According to analysts, Bitcoin’s NVT Ratio is technically an expression of inverse monetary velocity.

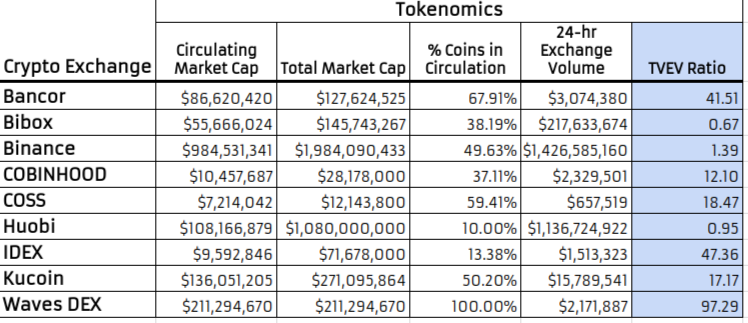

The TVEV ratio is similar to Bitcoin’s NVT: A Crypto Exchange Token’s TVEV is calculated by dividing the total market cap of the exchange token by the 24-hour exchange volume. To find the baseline TVEV for each Crypto Exchange Token above, I will track this ratio over a period of time. Ultimately, I’m hoping this data will serve as a metric for valuing not only Crypto Exchange Tokens against one another, but for valuing Crypto Exchange Tokens against other cryptocurrencies, as well.

In short, the higher the TVEV ratio for a Crypto Exchange Token, the more bullish the market is on the token’s prospects. Either there is a higher perceived token utility and a more valuable token model, or the market is more bullish on the prospects for capital appreciation (growth of investment). Conversely, a low TVEV ratio could mean that there is a low perceived utility (poor token model) for a Crypto Exchange Token. It is also possible that a low TVEV ratio may indicate an undervalued Crypto Exchange Token, so consider this data point as only one metric in your research.

Note: Tokenomics and exchange data as of 8/17/2018. The TVEV value for a one-day period does not allow for proper analysis. As such, consider today’s post as a snapshot to which I will be writing updates as TVEV data is gathered.

What can be gathered from the above data?

Lacking sufficient data to create the baseline we need for relevant comparison, we can minimally consider the TVEV ratios above as segmented into three ranges; let’s call them low-, mid-, and high-TVEV ratio Exchange Tokens.

- Low-TVEV Exchange Tokens: Ratio = 0.01 to 10.00

- Bibox (BIX): 0.67

- Huobi (HT): 0.95

- Binance (BNB): 1.39

- Mid-TVEV Exchange Tokens: Ratio = 10.01 to 20.00

- Cobinhood (COB): 12.10

- Kucoin (KCS): 17.17

- Coss (COSS): 18.47

- High-TVEV Exchange Tokens: Ratio = 20.01 and up

- Bancor (BNT): 41.51

- IDEX (AURA): 47.36

- Waves DEX (WAVES): 97.29

Speaking in pure conjecture, one could say that the Exchange Tokens in the Mid-TVEV range are lacking strong sentiment. There is evidence to prove this point, though:

- Cobinhood analysts wonder how the exchange will survive in an ICO bear market, when most of the operational expenses are covered by fund raising for start ups on their exchange.

- Coss investors rage in disappointment on reddit frequently.

- Kucoin has been having issues with attracting users and, in a much derided decision, recently hired Ian Balina as Ambassador.

It seems to me that the higher TVEV Exchange Tokens have lower volume, but very high expectation for capital growth opportunity, while the lower TVEV Exchange Tokens have better understand exchanges and known token models?

Let’s continue to watch this over the coming months so that trends can be identified.

Tokenomics by Exchange:

1. Bancor (BNT Token)

- Price: $1.66

- Circulating Tokens: 52,213,046 BNT

- Total Supply: 76,882,244 BNT

- % Tokens in Circulation: 67.91%

- Circulating Market Cap: $86,620,420

- Total Market Cap: $127,624,525

- 24-Hour Volume: $3,074,380

- TVEV: 41.51

2. Bibox (BIX Token)

- Price: $0.543937

- Circulating Tokens: 102,339,166 BIX

- Total Supply: 267,941,449 BIX

- % Tokens in Circulation: 38.19%

- Circulating Market Cap: $55,666,024

- Total Market Cap: $145,743,267

- 24-Hour Volume: $217,633,674

- TVEV: 0.67

3. Binance (BNB Token)

- Price: $10.31

- Circulating Tokens: 95,512,523 BNB

- Total Supply: 192,443,301 BNB

- % Tokens in Circulation: 49.63%

- Circulating Market Cap: $984,531,341

- Total Market Cap: $1,984,090,433

- 24-Hour Volume: $1,426,585,160

- TVEV: 1.39

4. COBINHOOD (COB Token)

- Price: $0.028178

- Circulating Tokens: 371,133,518 COB

- Total Supply: 1,000,000,000 COB

- % Tokens in Circulation: 37.11%

- Circulating Market Cap: $10,457,687

- Total Market Cap: $28,178,000

- 24-Hour Volume: $2,329,501

- TVEV: 12.10

5. COSS.io (COSS Token)

- Price: $0.060719

- Circulating Tokens: 118,810,622 COSS

- Total Supply: 200,000,000 COSS

- % Tokens in Circulation: 59.41%

- Circulating Market Cap: $7,214,042

- Total Market Cap: $12,143,800

- 24-Hour Volume: $657,519

- TVEV: 18.47

6. Huobi (HT Token)

- Price: $2.16

- Circulating Tokens: 50,000,200 HT

- Total Supply: 500,000,000 HT

- % Tokens in Circulation: 10%

- Circulating Market Cap: $108,166,879

- Total Market Cap: $1,080,000,000

- 24-Hour Volume: $1,136,724,922

- TVEV: 0.95

7. IDEX (AURA Token)

- Price: $0.071678

- Circulating Tokens: 133,832,967 AURA

- Total Supply: 1,000,000,000 AURA

- % Tokens in Circulation: 13.38%

- Circulating Market Cap: $9,592,846

- Total Market Cap: $71,678,000

- 24-Hour Volume: $1,513,323

- TVEV: 47.36

8. KuCoin (KCS Token)

- Price: $1.50

- Circulating Tokens: 90,730,576 KCS

- Total Supply: 180,730,576 KCS

- % Tokens in Circulation: 50.20%

- Circulating Market Cap: $136,051,205

- Total Market Cap: $271,095,864

- 24-Hour Volume: $15,789,541

- TVEV: 17.17

9. Waves DEX (WAVES Token)

- Price: $2.11

- Circulating Tokens: 100,000,000 WAVES

- Total Supply: 100,000,000 WAVES

- % Tokens in Circulation: 100%

- Circulating Market Cap: $211,294,670

- Total Market Cap: $211,294,670

- 24-Hour Volume: $2,171,887

- TVEV: 97.29

Coming up next: Stay tuned for Part 4, which will reveal a CryptoExchange Token matrix of data aggregated from Parts 1-3 of this blog series!

Thanks for reading!