Stablecoins have been gaining in prominence during this 2018 cryptocurrency bloodbath: Investors seek to stop the bleeding, while traders seek to de-risk their portfolios without having to move to fiat currencies. In continuing my research into the stablecoin sector, I recently interviewed Rune of @MakerDAO. I was excited to hear that Maker is more than a stablecoin, building a stable “ecosystem”, if you will, that enables a level playing field for finance around the world.

I hope this conversation sheds some light on Maker, a largely misunderstood project. Enjoy!

Interview with Rune of MakerDAO

TLDR: (MakerDAO strengths)

- Ecosystem and connections : seeking true adoption rather than trading and speculation

- Transparency is a clear motivation for the Maker team

- Tokenization trend : “Tokenize Everything”

- Traditional finance = inefficiencies

- Completely decentralized : especially important in large-scale trade and lending

- Open source : essential for quickly advancing stablecoin economics and the risk management field

What is MakerDAO?

MakerDAO is a decentralized organization dedicated to bringing stability to the crypto economy. MakerDAO issues Dai, the world’s first decentralized stablecoin on the Ethereum blockchain. Dai eliminates volatility through an autonomous system of smart contracts, specifically designed to respond to market dynamics.

With a presence on numerous cryptocurrency exchanges, multiple partnerships with global supply chain companies, and agreements with organizations serving non-government agencies, MakerDAO is unlocking the power of the blockchain to deliver on the promise of economic empowerment.

Held on the blockchain, Dai achieves stability via an open smart contract platform that allows anyone in the world to lock up their assets as collateral and issue Dai against them. Unlike other stablecoins there is no need to blindly trust a third party: When users want to retrieve their collateral, they simply return the Dai they issued plus a fee based on how long it was outstanding. True to the spirit of the blockchain, no one can alter these core mechanics of Dai, making it a safe and predictable form of money.

Importantly, the generation of Dai creates the components needed for a robust decentralized margin trading platform. We don’t just have the best economics, we also have the best blockchain tech amongst other stablecoins.

What about the use cases? Is there utility beyond speculation and traders?

Maker’s unique approach means we can peg the price of a new coin to anything. We can create new cryptocurrencies tomorrow pegged to the top ten global reserve currencies, or pegged to something completely different, such as a tokenized hedge fund, the Consumer Price Index, a basket of commodities… only one’s creativity limits the applications.

“Maker is an essential element of the tokenization trend.”

Another major use case is direct lending. Direct lending makes it very easy for the Maker governors to control the velocity of Dai via interest rates and the collateralization ratio.

MakerDAO makes several vital improvements over the central bank model. First, Maker eliminates the possibility of creating money from nothing. Second, with Maker, loans come directly from the “central bank.” This removes the ability of intermediary rent-seeking and permits Maker to charge an interest rate that is more in line with market demand, unlocking the full value of assets.

Maker intends to provide debt financing for the 21st century – programmable credit.

Finally, as a decentralized organization, Maker creates an environment where businesses and commerce aren’t limited by trust, or lack of. This value doesn’t exist anywhere else – MakerDAO is key infrastructure in the future of finance.

How is MakerDAO focused on good governance?

The goal of governance is to establish the most effective way to protect the integrity and stability of the Maker system. We achieve that goal by creating a decentralized, open scientific risk management community: A community that will make clear arguments and apply competing models to assess and manage the risks underlying the system. The community will initially be guided by the foundation, but eventually be lead by a multitude of risk teams that are formally elected by MKR vote (more on that below).

The stability of the system is always exposed to systemic and idiosyncratic risks. Risks that require well-established models to identify, quantify and manage them. A decentralized risk function will have open competitive models that will continuously evolve to understand better and manage risk. The competition will ensure that the threats to the system are well studied and that a high likelihood exists that the best models are applied.

As we move towards a more decentralized risk function, risk teams that are approved by Maker token holders will have their risk constructs included in the system. The output of these risk constructs will consist of assessments and risk parameters for the system. Risk constructs may differ concerning what kinds of evaluations and risk parameters they output, or, on what kind of tokens they produce this output. Risk constructs may eventually include diagnostic risk management models for the entire collateral portfolio. Consequently, we can see how a collection of risk constructs could ultimately cover every aspect of the risk management function.

Maker token holders will eventually and ultimately manage the risk function of the system, and it will do so through the use of its voting mechanism. This mechanism will include two groups of functionality (proactive and reactive) and two forms of votes. The first vote (the Governance Vote) will require resolution, while the second vote (the Executive Vote) will be able to enact that resolution into the system.

“Decentralization is gradual. We are taking a layered approach and empowering our token holders over time to create a communication framework with an unbreakable equilibrium.”

How does MakerDAO work?

Maker is a platform on Ethereum that backs and stabilizes the value of Dai through unique smart contracts called Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and appropriately incentivized external actors.

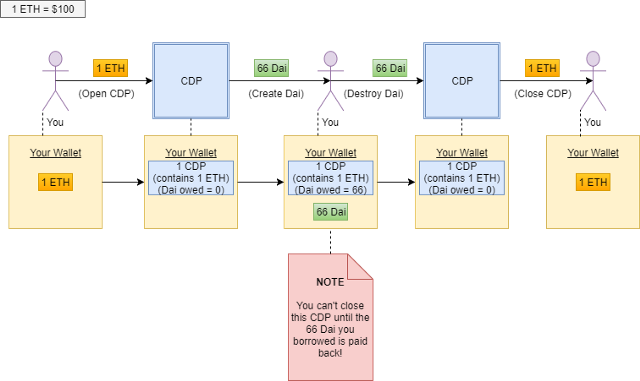

The purpose of the CDP is two-fold: to accept pledged collateral tokens and to make a Dai credit facility available. In other words, CDPs provide loans and attempt to mitigate credit risk at the same time. Anyone who has collateral assets can leverage them to generate Dai on the Maker Platform through Maker’s CDPs.

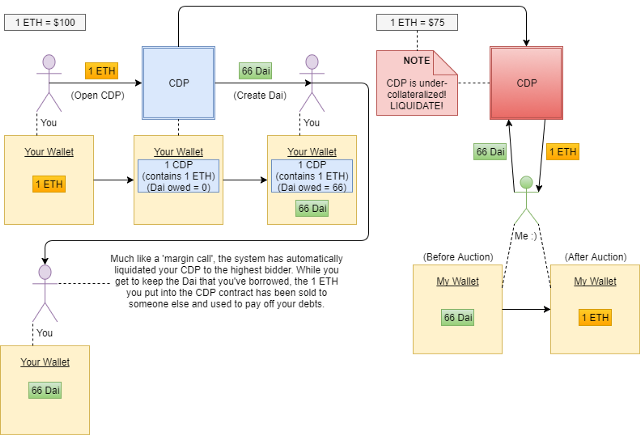

CDPs hold collateral assets deposited by a user and permit this user to generate Dai, but generating also accrues debt. This debt effectively locks the deposited collateral assets inside the CDP until it is later covered by paying back an equivalent amount of Dai, at which point the owner can again withdraw their collateral.

“Active CDPs are always collateralized in excess, meaning that the value of the collateral is higher than the value of the debt.”

A CDP being liquidated due to insufficient collateral :

Opening and closing a CDP while creating/destroying Dai :

How is MakerDAO focused on real adoption?

We’re focusing on high profile business partnerships and global enterprise in an effort to promote economic empowerment, eliminating friction to growth for small businesses around the world. In addition, we believe that the un- and under-banked will become long terms users.

Our recent partnerships include:

Bifrost

Project Bifröst is an initiative introducing multiple, humanitarian aid focused solutions based on cryptocurrency and blockchain technology. “Our debut solution, a mobile application called Dether, allows you to send money anywhere in the world in an instantaneous, transparent, and stable manner and serves as an alternative to international wire transfer services, which can take up to 2-4 weeks and have a 10% transaction cost.”

The current, international wire transfer process that nonprofits use is a lengthy and expensive process, often taking weeks to get to impact areas at a high transaction cost. Using Dether, a Crypto-to-Cash application, and the stablecoin DAI, a cryptocurrency decentrally pegged to $1.00 USD, nonprofits and individuals alike can send funds anywhere in the world instantly. Once the agent on the ground receives the funds in DAI, the Dether app facilitates a way to find other users that will exchange the stablecoin for the region’s national currency, all with minimal to no Tx cost.

Swarm Fund

Swarm Fund is the blockchain for private equity. Swarm is creating a unique market infrastructure built on blockchain technology that enables investing cryptocurrency into real assets and deploying traditional capital into crypto markets in a new way.

Swarm has partnered with MakerDAO to integrate the Dai token into the Swarm platform. This will give Swarm’s community of accredited investors a greater capability to lock in crypto prices, using the world’s first decentralized stablecoin on the Ethereum blockchain.

Swarm investors will be able to lock in value using the Dai stablecoin in two phases. The first phase is live now and enables investing with Dai, which is pegged to the US Dollar. The second phase will allow investors to lock in the price of the crypto they invest on Swarm, with Bitcoin or Ethereum converted to Dai, locking in the price at the time of commitment to an investment, or automatically based on ceiling and floor prices set by the individual investor.

Tradeshift

Tradeshift drives supply chain innovation for the digitally connected economy. As the leader in supply chain payments and marketplaces, the company helps buyers and suppliers digitize all their trade transactions, collaborate on every process, and connect with any supply chain app. More than 1.5 million companies across 190 countries trust Tradeshift to process over half a trillion USD in transaction value, making it the largest global business network for buying and selling.

Tradeshift and MakerDAO have partnered on a project to unlock liquidity access for small businesses around the globe from the $9T of capital trapped in outstanding receivables.

The partnership combines the power of the Tradeshift business commerce platform with the stability and security of the Dai Credit System to establish a supply chain liquidity marketplace for businesses, developers and investors.

- Businesses can leverage trade receivables, purchases and other transactions and digital assets on the Tradeshift platform to create real-time and short-term financing models backed by anything from institutional finance to peer lending.

- Developers can build investor applications to enable real-world B2B settlements that benefit from the efficiency, transparency, speed and security of the blockchain utilizing the Dai stablecoin.

- Investors can benefit from a completely new range of low-friction, low-cost financial applications as a result of making real-world assets, such as invoices, available on the blockchain in a standardized “tokenized” and interoperable format.

“The trade receivables market has very tight margins, which leaves no room for a volatile digital currency as instrument for settlement. The Dai Credit System is a unique vision for a transparent and stable token that allows anyone to represent real-world currency settlements on the blockchain. It is a vision that we are very excited about.” – Tradeshift co-founder Gert Sylvest

“Our partnership with Tradeshift proves the potential of the blockchain to level the economic playing field for businesses of all sizes around the globe. At the same time, we’re delivering new options for investors by creating an entirely new class of investment vehicles with vetted risk, based on real world assets.” – Rune of MakerDAO

Wyre

Wyre, the leading blockchain money transfer company operating a regulated global payment infrastructure, has announced the availability of Dai as a trading pair, allowing for fast and compliant conversion of fiat currencies to Dai.

Wyre specializes in infrastructure to bridge the gap between traditional banking and digital assets. Working together, MakerDAO and Wyre allow organizations to compliantly move fiat currency directly into and out of Dai, removing exposure to the unpredictability of speculative cryptocurrencies such as Ethereum or Bitcoin while benefiting from the speed, transparency and security of the blockchain.

Pairing Dai to Wyre’s trading engine and global fiat on-ramps and off-ramps will enable nearly-instant movement of funds across borders. By decreasing the amount of time it takes to clear payments, businesses can increase the number of payment cycles, therefore increasing revenue. Remittance platforms or crypto services can also settle instantly in Dai rather than using international wires which can take up to 48 hours.

For organizations looking to use Dai, Wyre offers an elegant API to connect bank accounts to the blockchain through Dai, while taking care of AML/KYC onboarding and compliance issues. Organizations can programmatically access Dai trading pairs against major fiat currencies (USD, EUR, AUD, GBP, CAD, HKD, CNY) as well as major cryptocurrencies (BTC and ETH). On-ramps and off-ramps for local settlements are currently available in 30+ countries to API partners.

“Expanding the Maker ecosystem, organizations can now benefit from the instant, secure and scalable power of blockchain without having to first buy/sell volatile crypto assets like Ethereum or Bitcoin.” – Rune of MakerDAO