In this author’s experience, many trading strategies are best understood through option analysis. For example, the classic strategy of rebalancing a Permanent Portfolio to preserve wealth and maintain a fixed-leverage ratio can be shown to have option-like payoffs.

The purpose of this post is to introduce options, briefly discussing the uses and applications before looking at key types of options exposures.

What are options?

An option is a contract that allows its owner the right, but not the obligation, to execute a specified transaction in the future. Options comes in two flavors: calls options and put options. However, in combination “calls” and “puts” offer nearly unlimited strategies, some of which are highlighted in the following sections.

What are call options?

Call options are financial contracts that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity or other asset or instrument at a specified price within a specific time period. Until the option contract expires the option buyer has the right to those shares at that agreed upon price regardless of current market price. In exchange for this right, the option purchaser pays what’s called an “option premium.”

Investors most often buy calls when they are bullish on an asset as calls allow the use of leverage to maximize gains. In addition, call options dramatically reduce the maximum loss an investment can incur. These two elements are essential in risk management.

Call options can be in, at, or out of the money. In the money means the underlying asset price is above the call strike price. Out of the money means the underlying price is below the strike price. At the money means the underlying price and the strike price are the same.

It is worthwhile for the call buyer to exercise their option, and require the call writer/seller to sell them the stock at the strike price, only if the current price of the underlying is above the strike price. For example, if the stock is trading at $9 on the stock market, it is not worthwhile for the call option buyer to exercise their option to buy the stock at $10 because they can buy it for a lower price on the market.

When a call option is in-the-money the investor has several options: (1) He can sell the call and book his profit. (2) If he still feels that there is scope of making more money he can continue to hold the position. (3) If he is interested in holding the position but at the same time would like to have some protection, he can buy a protective “put” of the strike that suits him. (4) He can sell a call of higher strike price and convert the position into “call spread”, thus limiting his loss if the market reverses.

What are put options?

A put is an option contract that gives the buyer the right to sell the underlying asset at a set price at any time up to the expiration date. For this right an options premium is paid. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying asset and the term “put” comes from the fact that the owner has the right to “put up for sale” the asset.

With puts, an investor can take a short position in an underlying asset without trading in it directly. The put buyer either believes that the underlying asset’s price will fall by the exercise date or hopes to protect a long position in it. The advantage of buying a put over short selling the asset is that the option owner’s risk of loss is limited to the premium paid, whereas the asset short seller’s risk of loss is technically unlimited.

Put options can be in, at, or out of the money. In the money means the underlying asset price is below the put strike price. Out of the money means the underlying price is above the strike price. At the money means the underlying price and the strike price are the same.

It is worthwhile for the put buyer to exercise their option, and require the put writer/seller to buy the stock from them at the strike price, only if the current price of the underlying is below the strike price. For example, if the stock is trading at $11 on the stock market, it is not worthwhile for the put option buyer to exercise their option to sell the stock at $10 because they can sell it for a higher price on the market.

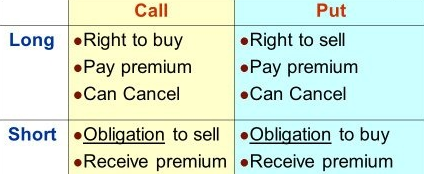

Cheat sheet:

Option uses and applications:

The sensitivities of option prices to the variables that determine their prices are important inputs to many hedging strategies and risk management techniques. Call and put options usually have four underlying variables that normally change: the underlying asset, the return volatility of the underlying asset, the time to expiration, and the riskless interest rate.

Option sensitivities have multiple uses. The trader, for example, uses the sensitivities to establish hedge ratios. In addition, option sensitivities can be integrated into a comprehensive risk management approach. In short, options can be useful to both the trader and the investor.

Key reasons to consider using options include the following:

- Arbitrage – options arbitrage for little to zero-risk returns

- Flexibility – increased trading strategies provide nearly unlimited flexibility

- Hedging risk – restrict losses

- Income – an effective options strategy can be a stable income producer

- Leverage – multiply returns and improve cost-basis

- Tax management – reduce exposure to an asset without selling it

Types of options exposures:

Risk exposure graphs best express the outcomes of establishing a position in an option and holding that position until maturity of the option, at which time the option is exercised if in-the-money. Check out the risk exposures below for various options positions.

Calls or puts, long or short:

In the graphs below, the vertical axis above the origin indicates profits, and below the origin indicates losses. The horizontal axis expresses the price of the underlying asset. Note that long calls, long puts, short calls, and short puts are represented.

As you can see, while long call options generate unlimited exposure to the upside of the underlying asset, put options do not have unlimited exposure in either direction. Remember, the underlying asset’s price cannot go below zero.

Calls and puts in combination:

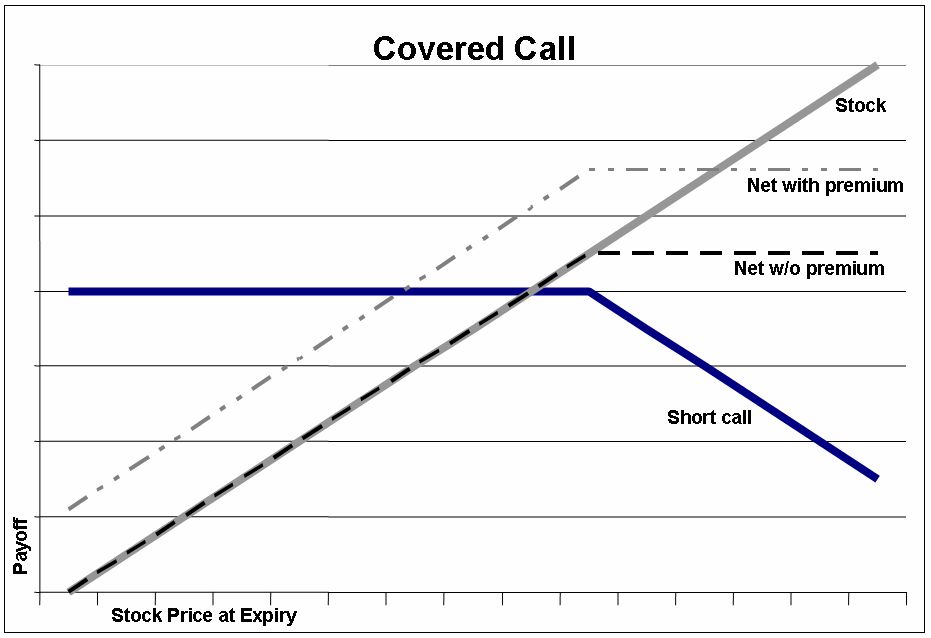

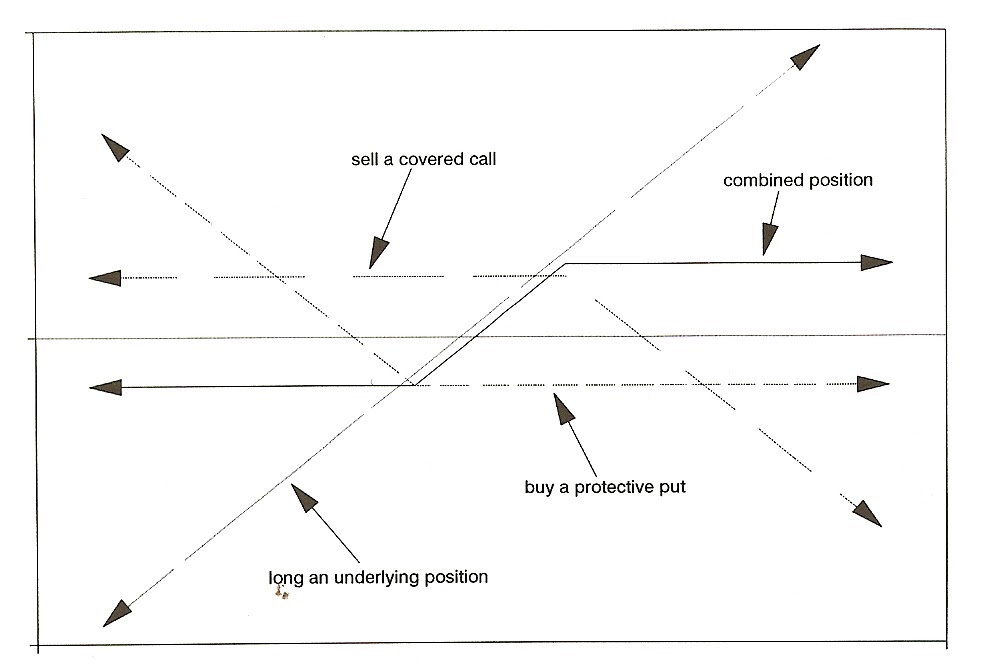

Calls and puts are used in combination to hedge risk. Two popular option combinations used to hedge risk include the “covered call” and the “protective put.”

A covered call combines being long as asset with being short a call option on the same asset. A protective put combines being long as asset with a long position in a put option on the same asset. An unhedged option is often referred to as “naked option.” Special note: A covered call has the same net risk exposure as a naked put, and a protective put has the same net risk exposure as a call option.

Covered calls:

Some investors use call options to generate income through a covered call strategy. This involves owning an underlying asset while at the same time writing a call option, or giving someone else the right to buy your asset. This strategy is often referred to as a “buy-write” strategy.

The investor collects the option premium and hopes the option expires worthless (below strike price). This strategy generates additional income for the investor but can also limit profit potential if the underlying asset price rises sharply.

Covered calls work because, if the asset rises above the strike price, the option buyer will exercise their right to buy the asset at the lower strike price. This means the option writer doesn’t profit on the asset’s movement above the strike price. The options writer’s maximum profit on the option is the premium received. Special note: Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price (or premium) should be the same as the premium of the short put or naked put.

There are several benefits from this options trading approach: (1) Increase yield. (2) Defines an exit price. (3) Lower cost basis of a long position – income received effectively lowers acquisition price.

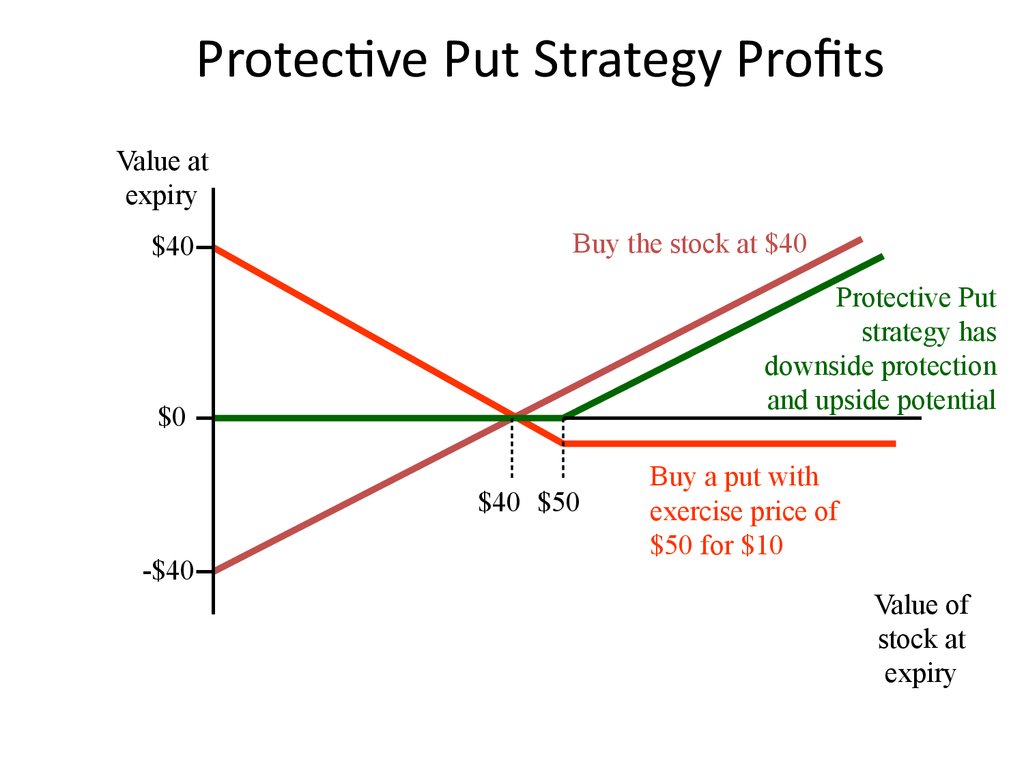

Protective puts:

The most obvious use of a put is as a type of insurance. In the protective put strategy, also called a “married put”, the investor buys enough puts to cover their holdings of the underlying asset so that if a drastic downward movement of the underlying asset’s price occurs, they have the option to sell the holdings at the strike price.

Since the investor is purchasing the asset and an equal number of puts, there is an overall net debit for the position. The total out of pocket value to enter into a Married Put trade is equal to the price of the stock plus the premium of the put option. This value is referred to as the Net Debit.

The maximum profit for the position is unlimited as the stock could rise infinitely. The maximum monetary value at risk is equal to the net debit for the position minus the strike price of the purchased put.

This is a bullish strategy, as the investor is looking for an increase in the underlying stock price to earn a profit. The purchased put gives the investor extra insurance on the position for an additional cost. Special note: married puts offer the same risk/reward profile as a long call, but the investor owns the asset rather than the depreciating call value.

Advantages of this strategy include: (1) Can be used with an income generating strategy such as covered calls to create collar positions. (2) Potential profits are unlimited. (3) Max loss is limited due to the protection of the put. (3) Allow investors to enter a long position in an asset with a low risk value.

Covered call and protective puts in combination:

Covered calls and protective puts can be used in combination to hedge risk, as well. This risk exposure is illustrated below.

One of the basic mistakes covered call traders make is that they trade for the highest premium available to maximize their monthly income without looking at the amount of risk they are taking on with this type of trade. When option premiums are high, there is some uncertainty around increased risks.

The advanced covered call trader knows this and uses a protective put to manage their risk of loss on a high volatility trade.

Trading a covered call/protective put combination can be a great way to harvest many of the benefits of a covered call while maintaining fixed risk to the downside. When protective puts are integrated into the covered call writing strategy it is known as the “collar strategy.” The covered call aspect of the trade generates cash flow and the protective put leg serves as an insurance policy against catastrophic share depreciation.

Where can I use options?

Having reviewed the primary advantages of options, it’s evident why they seem to be the center of attention in financial circles today. Increased cost-efficiency, increased returns, and reduced risk are just a few of the advantages offered by options. With online brokerages providing direct access to the options markets and very low commission costs, the average retail investor now has the ability to use one of the most powerful tools in the investment industry.

For cryptocurrency options, I recommend traders and investors check out OKEx. Options trading is launching soon and the exchange has great support. They are constantly expanding their services and infrastructure, have good volume, and growth is stable. Here’s a blog post from OKEx introducing their options services for more information: OKEx Options 101 – Learn the basics of options trading, key terms, and benefits.